When can we file taxes 2025? That is the million-dollar query, is not it? The yearly tax ritual – a dance between us and Uncle Sam, a fragile waltz of deductions and declarations. However concern not, intrepid taxpayer! This is not some impenetrable tax code labyrinth. We’ll navigate the 2025 tax season collectively, uncovering the deadlines, deciphering the brand new guidelines (sure, there could be some!), and making the entire course of much less of a headache and extra of… nicely, possibly not a celebration, however actually much less of a trial by hearth.

Consider it as a pleasant information via the marginally bewildering world of tax filings, armed with the data it is advisable conquer this yearly problem with confidence and a smile (or not less than a sigh of aid).

This yr brings its personal distinctive set of circumstances. We’ll delve into the official submitting deadline for 2025, discover the potential of extensions (as a result of let’s be sincere, we have all wanted one sooner or later!), and unpack any important modifications to the tax legal guidelines that may influence your return. We’ll additionally discover completely different submitting strategies, from the comfort of on-line submitting to the marginally extra old-school strategy of snail mail.

Lastly, we’ll arm you with an inventory of vital paperwork and, simply in case, a delicate overview of potential penalties for late submissions. So seize your favourite beverage, settle in, and let’s conquer this collectively!

Tax Submitting Deadlines 2025

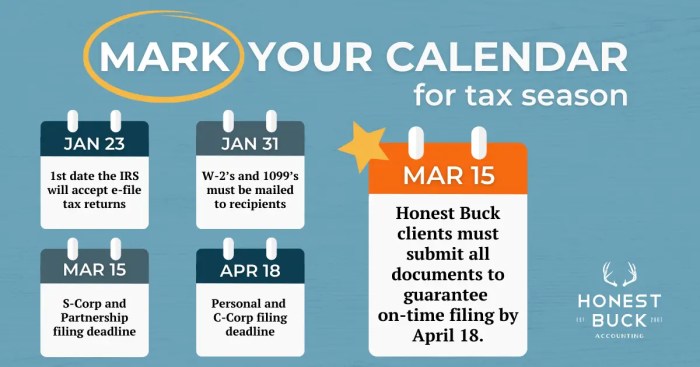

Ah, taxes. That annual ritual that’s as predictable because the dawn, but someway manages to sneak up on us each single time. Let’s get organized and conquer this yr’s tax season head-on, we could? Understanding the deadlines is the primary essential step towards a smoother, much less annoying expertise.The usual tax submitting deadline for particular person earnings tax returns in the USA for the 2025 tax yr (masking earnings earned in 2024) is often April fifteenth, 2025.

Tax time’s a whirlwind, proper? We’ll be submitting our 2025 taxes in April, as regular. However earlier than we dive into these types, let’s plan forward! Figuring out when essential dates fall, like non secular holidays, is essential to a smoother yr. As an example, determining when to rejoice is simply as essential as submitting taxes, so try when Eid al-Adha is well known in 2025 by visiting this beneficial web site: when is eid adha 2025.

Getting organized early makes tax season much less annoying, permitting you to benefit from the festivities with no monetary headache. So, keep in mind April for taxes, and plan your celebrations accordingly!

Consider it because the day the tax man (or lady!) comes calling. Mark it in your calendar, set a reminder in your telephone – do no matter it takes to make sure you don’t miss it! This date applies to most taxpayers, offering a constant benchmark for planning and preparation.

Tax season 2025? Suppose April fifteenth (often!). However earlier than you wrestle with W-2s, think about this: securing your spot on the celestial extravaganza that’s Moon Crush 2025 requires snagging tickets now, from moon crush 2025 tickets. Do not let the cosmic mud settle earlier than you’ve got booked your lunar journey! Then, after the moonbeams fade, it is again to the earthly actuality of submitting these taxes – so get organized!

Tax Submitting Deadline Extensions

Life, as everyone knows, is never easy. Surprising occasions can generally make assembly the April fifteenth deadline a problem. Thankfully, the IRS understands this and provides extensions to those that qualify. An automated six-month extension is obtainable, pushing the deadline again to October fifteenth, 2025. Nonetheless, it’s essential to grasp that this extension is for

Tax time’s a-comin’, of us! For 2025, the standard suspects apply: April fifteenth is the massive day, except it falls on a weekend – then it shifts. However for instance you want a countdown to a particular date, possibly to mark your tax prep progress? Try this helpful countdown: how many days until May 10th 2025.

Figuring out the precise variety of days left would possibly simply show you how to keep on schedule, conquer that tax return, and really feel the candy aid of accomplishment! So, keep in mind April fifteenth (or the adjusted date), and you will be golden.

- submitting* your return, not for

- paying* your taxes. The cost deadline stays April fifteenth. Failing to pay on time will lead to penalties, even with an extension granted for submitting. To acquire this extension, you merely have to file Kind 4868, Software for Automated Extension of Time To File U.S. Particular person Earnings Tax Return, earlier than the unique April fifteenth deadline.

Consider it as a brief reprieve, an opportunity to catch your breath and get all the pieces so as. That is significantly useful for people with complicated tax conditions or those that want extra time to collect vital documentation. Think about the peace of thoughts!

Normal and Prolonged Deadlines Comparability

| Deadline | Circumstances |

|---|---|

| April 15, 2025 | Normal deadline for many taxpayers. |

| October 15, 2025 | Automated six-month extension granted by submitting Kind 4868 earlier than April 15,

2025. Observe This extends the submitting deadline solely; taxes are nonetheless due April 15, 2025. |

Bear in mind, proactive planning is essential. Do not let the tax deadline creep up on you unexpectedly. Begin gathering your tax paperwork early, and should you anticipate needing an extension, file Kind 4868 nicely prematurely of April fifteenth. Taking these steps will assist guarantee a smoother and fewer annoying tax season.

Tax time’s a-comin’! For 2025, the deadline’s sometimes in April, however do not stress; we have this. Whilst you’re planning your monetary future, you may also be eyeing a shiny new journey, maybe testing the acura mdx 2025 release date – a good way to reward your self after a profitable tax season! Bear in mind, procrastination is the thief of time (and doubtlessly, an excellent refund!), so get these tax types sorted early.

Joyful submitting!

You’ve bought this! This yr, let’s conquer tax season with confidence and a smile. The sensation of accomplishment after submitting your taxes on time is extremely rewarding. Embrace the problem, and keep in mind, you might be able to dealing with this.

Influence of Tax Regulation Adjustments on 2025 Submitting

Navigating the tax panorama can really feel like an exciting journey, generally a bit like a treasure hunt, however with doubtlessly much less buried gold and extra paperwork. Let’s discover how potential modifications in tax legal guidelines would possibly influence your 2025 submitting expertise. Bear in mind, that is based mostly on present projections and potential laws; all the time seek the advice of official sources for the ultimate phrase.The 2025 tax season may see some important shifts in comparison with earlier years.

Policymakers are continuously evaluating and adjusting the tax code, aiming for a system that is each truthful and efficient. These modifications, whereas doubtlessly complicated, can supply alternatives for taxpayers to optimize their returns. Let’s delve into some potential eventualities.

Potential Tax Regulation Adjustments and Their Influence

It is essential to grasp that tax laws is a dynamic course of. Whereas predicting the longer term with full accuracy is unimaginable, we will study some probably areas of change based mostly on present discussions and proposed payments. These modifications may affect all the pieces out of your tax bracket to the credit and deductions you are eligible for. For instance, debates round increasing the kid tax credit score or adjusting earnings thresholds for sure deductions are ongoing.

These shifts, ought to they materialize, may considerably alter the 2025 tax submitting course of for a lot of households. The potential influence ranges from modest changes to substantial financial savings, relying on particular person circumstances.

New Tax Credit and Deductions

Think about a world the place tax season is much less annoying, possibly even… fulfilling? Nicely, new tax credit and deductions may contribute to that dream. Whereas the particular particulars stay to be seen, a number of proposals give attention to incentivizing particular behaviors or supporting specific teams. As an example, an enlargement of the clear vitality tax credit score may considerably profit householders investing in photo voltaic panels or different renewable vitality options.

Equally, elevated deductions for schooling bills or healthcare prices may present aid for a lot of taxpayers. These are simply prospects; the precise end result will rely on the ultimate laws.

Comparability of 2025 Tax Brackets with Earlier Years

Let’s speak tax brackets – these numerical ranges that decide your tax fee. Vital modifications in tax brackets may influence many taxpayers, significantly these in larger earnings ranges. For instance, a widening of the brackets on the decrease finish may doubtlessly result in decrease tax burdens for a lot of, whereas changes on the larger finish may shift the tax burden.

Contemplate this: a hypothetical enhance in the usual deduction may lead to fewer folks owing taxes, whereas changes to capital positive aspects charges may influence traders otherwise. Once more, these are illustrative examples, not predictions. The precise tax brackets for 2025 will likely be decided by official authorities bulletins.

- Potential Growth of Little one Tax Credit score: This might present important aid for households with youngsters.

- Adjustments to Capital Positive factors Tax Charges: Changes to those charges may have a substantial influence on traders.

- Elevated Deductions for Healthcare Bills: This might ease the monetary burden of healthcare prices for a lot of.

- New or Expanded Clear Power Tax Credit: These may incentivize environmentally pleasant investments.

- Modifications to Earnings Tax Brackets: Shifts in tax brackets may have an effect on the tax burden for numerous earnings ranges.

Submitting Strategies for 2025 Returns

So, the massive day is approaching – tax time! Let’s make this yr’s submitting as clean as attainable by exploring your choices. Selecting the best technique can prevent time, stress, and possibly even a couple of complications. Consider it as selecting your journey – will you conquer the digital realm or embrace the basic pen-and-paper strategy?Selecting your tax submitting technique is a bit like selecting the proper pair of sneakers – it wants to suit your persona and way of life.

There are a number of methods to ship your tax data to the IRS, every with its personal set of benefits and drawbacks. Let’s break down the most typical strategies and see which one is the perfect match for you.

E-filing

E-filing, the digital dance of tax preparation, is quickly changing into the most well-liked technique. It is quick, environment friendly, and provides a stage of comfort that is exhausting to beat. Consider it as your tax return getting a VIP categorical cross to the IRS.Think about this: you are sitting comfortably at house, sipping your favourite beverage, and with a couple of clicks, your tax return is on its manner.

Tax time’s a whirlwind, proper? Determining after we file taxes in 2025 is essential, however hey, let’s take a fast break! Want a distraction? Try the exhilarating rugby sevens 2025 schedule for some critical adrenaline. Again to taxes – keep in mind, planning forward is essential to a clean submitting expertise, so do not delay; get organized and conquer that tax return! You bought this!

No stamps, no envelopes, no annoying journeys to the submit workplace. Moreover, e-filing typically comes with the added bonus of faster processing instances and fewer errors. The IRS usually processes e-filed returns a lot quicker than paper returns, that means you may get your refund sooner should you’re due one. Nonetheless, you may want entry to a pc and dependable web connection, and there is all the time the potential for technical glitches, though respected tax software program suppliers have strong programs in place to attenuate these.

Mail Submitting, When can we file taxes 2025

The tried-and-true technique, mailing your return, nonetheless holds its place, particularly for many who favor the tangible really feel of paper and pen. It is a easy course of: print your tax types, fill them out meticulously, and ship them off by way of mail. The fantastic thing about this technique lies in its simplicity – no expertise required. It is a reliable choice for these much less snug with computer systems or those that have restricted web entry.

Nonetheless, mailing your return takes longer, will increase the danger of errors or misplaced mail, and the watch for processing and your refund might be considerably longer. Additionally, keep in mind to make a copy of your return to your data. Contemplate it your insurance coverage coverage in opposition to any unexpected circumstances.

Comparability of Submitting Strategies

Let’s get a clearer image with a easy comparability:

| Methodology | Benefits | Disadvantages |

|---|---|---|

| E-filing | Quick, handy, usually faster processing, fewer errors, typically free software program choices accessible. | Requires laptop and web entry, potential for technical glitches, reliance on software program or on-line providers. |

| Mail Submitting | Easy, no expertise required, appropriate for these with restricted web entry. | Sluggish processing, larger threat of errors and misplaced mail, longer watch for refunds. |

Steps Concerned in E-filing a Tax Return

E-filing would possibly sound daunting, but it surely’s truly fairly easy. Consider it like following a recipe – simply observe the steps, and you will be accomplished earlier than it!First, collect all of your vital tax paperwork – W-2s, 1099s, and another related types. Subsequent, select your e-filing technique: tax preparation software program (TurboTax, H&R Block, TaxAct, and many others.), a tax skilled’s e-filing service, or the IRS’s Free File program (for many who meet the earnings necessities).

Then, fastidiously enter all of the required data into the software program or on-line platform. Double-check all the pieces for accuracy – a small mistake can result in delays and even penalties. When you’re assured in your return’s accuracy, overview and submit it electronically. Lastly, make a copy of your filed return to your data – a digital copy is adequate.

It is like having a backup plan to your tax journey.Bear in mind, selecting the best technique is essential to a stress-free tax season. Embrace the method, and you will find that submitting your taxes would not should be the dreaded occasion many understand it to be. It is a possibility to take management of your funds and plan for a brighter future.

Required Documentation for 2025 Tax Submitting

Getting your tax paperwork collectively would possibly seem to be a chore, however consider it as a spring cleansing to your funds! It’s an opportunity to get organized and perceive the place your cash went final yr. Let’s make this as painless as attainable. We’ll cowl all the pieces it is advisable file precisely and keep away from any unwelcome surprises from the IRS.

Bear in mind, accuracy is essential – it saves you time and potential complications down the road.Gathering the correct paperwork is essential for a clean tax submitting expertise. Lacking even one very important doc can result in delays, and no person needs that. So let’s dive into the important paperwork you may want to your 2025 tax return. Contemplate this your final guidelines for tax success!

W-2 Kinds: Your Wage Report

Your W-2 kind, issued by your employer, particulars your earnings and the taxes withheld out of your paycheck all year long. It is the cornerstone of your tax return for wage earners. The W-2 consists of your identify, social safety quantity, the entire quantity you earned, and the quantity of taxes your employer withheld. With out it, you possibly can’t precisely report your earnings.

Think about making an attempt to construct a home with no basis – unimaginable! Equally, submitting with out your W-2 is a recipe for catastrophe. The IRS wants this data to confirm your earnings and make sure you’re paying the correct quantity of taxes. A lacking or incorrect W-2 could cause important delays in processing your return.

1099 Kinds: Earnings Past Employment

In case you obtained earnings from sources aside from your employer – freelance work, investments, and even gig financial system platforms – you may probably obtain a 1099 kind. There are numerous sorts of 1099 types (1099-NEC, 1099-INT, 1099-DIV, and many others.), every reporting completely different sorts of earnings. These types are important for precisely reporting all of your earnings sources. For instance, a 1099-NEC reviews non-employee compensation, like funds to freelancers.

A 1099-INT reviews curiosity earnings from financial institution accounts. Failure to report this earnings precisely can lead to penalties and curiosity costs. It’s like forgetting to declare a invaluable piece of jewellery when going via customs – you’ll face penalties. Guarantee you may have all related 1099 types, appropriately crammed and matched together with your earnings data.

Kind 1098: Mortgage Curiosity Assertion

Owners who itemize their deductions will want Kind 1098, which particulars the mortgage curiosity they paid through the yr. This type helps you declare the mortgage curiosity deduction, lowering your taxable earnings. It consists of the entire quantity of mortgage curiosity paid, which is essential for calculating your deduction. Failing to incorporate this might imply lacking out on a invaluable tax break, costing you cash.

Consider it as leaving cash on the desk – you’ve got earned it, so declare it! The knowledge on the 1098 is important for correct calculation of your deductions.

Different Related Paperwork

Past the types talked about above, you would possibly want different paperwork relying in your particular person circumstances. These may embody receipts for charitable donations (if itemizing), documentation for enterprise bills (if self-employed), data of schooling bills (for schooling credit), or proof of dependents. Maintain all these data meticulously organized all year long. Consider this as constructing a robust case to your tax return – the extra organized and detailed your documentation, the smoother the method will likely be.

It is a journey in direction of monetary readability and peace of thoughts! Bear in mind, proactive group makes tax season a breeze.

Understanding Tax Penalties for Late Submitting in 2025: When Do We File Taxes 2025

Let’s face it: nobodyloves* coping with taxes. However understanding the potential penalties of a late submitting can assist you keep away from a really disagreeable shock. We’ll discover the penalties for late tax submitting in 2025, providing a transparent image of what you would possibly face and the way these penalties are calculated. Consider this as your pleasant information to navigating the sometimes-tricky world of tax penalties.The penalties for late tax submitting in 2025 should not one thing to take evenly.

The IRS imposes penalties for each late submitting and late cost, and these can shortly add up. The penalties aren’t designed to be punitive, however slightly to encourage well timed compliance with tax legal guidelines. Understanding these penalties empowers you to make knowledgeable selections and keep away from pointless monetary burdens.

Late Submitting Penalties Calculation

The penalty for late submitting is mostly calculated as a proportion of the unpaid tax. This proportion will increase the longer you delay. For instance, should you owe $1,000 in taxes and file 60 days late, you may probably face a penalty. The precise proportion can fluctuate, and it is essential to seek the advice of the official IRS pointers for essentially the most up-to-date data.

Bear in mind, this penalty is separate from any curiosity charged on the unpaid taxes themselves. Consider it like this: the late submitting penalty is a price for being late, whereas curiosity is the price of borrowing cash from the federal government.

The late submitting penalty is often calculated as a proportion of the unpaid taxes due, rising with the size of the delay. This penalty is separate from any curiosity accrued on the unpaid quantity.

Comparability of Penalties: Late Submitting vs. Inaccurate Reporting

Whereas late submitting carries important penalties, inaccurate reporting incurs its personal set of penalties. These penalties might be a lot larger than these for late submitting alone, typically involving extra assessments and doubtlessly even authorized motion. Inaccurate reporting, corresponding to omitting earnings or claiming incorrect deductions, can result in audits and investigations. In distinction, a late submitting penalty is primarily a time-based price for not assembly the deadline, assuming the reported data is correct.

The distinction is important: one is a matter of timing, the opposite is a matter of accuracy. Avoiding each is, naturally, the perfect technique.

Illustrative Penalty Eventualities

Think about three completely different eventualities:Situation 1: A taxpayer recordsdata their 2025 return 60 days late, owing $1,000 in taxes. They could face a penalty of, say, 5% of the unpaid taxes (5% of $1000 = $50) plus curiosity on the unpaid quantity.Situation 2: A taxpayer recordsdata their 2025 return 120 days late, owing $5,000. The penalty would possibly soar to 10% (10% of $5000 = $500), plus curiosity, reflecting the higher delay.Situation 3: A taxpayer recordsdata on time however considerably underreports their earnings, leading to an extra tax legal responsibility of $2,000.

The penalties for inaccurate reporting may very well be significantly larger, maybe together with a penalty proportion of the underreported quantity plus curiosity and doubtlessly extra penalties for intentional disregard of tax guidelines.This illustrative chart highlights the escalating nature of penalties: The longer the delay, the upper the price. Inaccurate reporting carries much more extreme penalties. Bear in mind, these are illustrative examples; the precise penalties can fluctuate based mostly on quite a few components, and it’s best to all the time discuss with the IRS for essentially the most exact data.

It is all the time greatest to file on time and precisely.